9 Simple Techniques For Succentrix Business Advisors

9 Simple Techniques For Succentrix Business Advisors

Blog Article

The 9-Second Trick For Succentrix Business Advisors

Table of ContentsThe Ultimate Guide To Succentrix Business AdvisorsSuccentrix Business Advisors for BeginnersGetting My Succentrix Business Advisors To WorkExcitement About Succentrix Business AdvisorsSuccentrix Business Advisors - An Overview

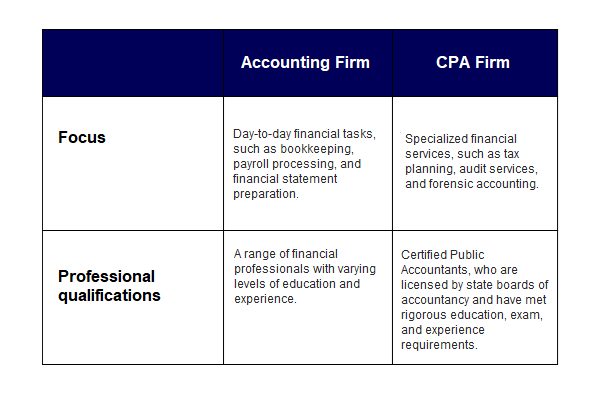

Getty Images/ sturti Contracting out audit services can liberate your time, avoid errors and also lower your tax obligation bill. The excessive range of remedies may leave you baffled. Do you require an accountant or a cpa (CERTIFIED PUBLIC ACCOUNTANT)? Or, perhaps you intend to manage your basic bookkeeping jobs, like accounts receivables, yet hire a professional for cash circulation forecasting.Discover the various sorts of accountancy services available and find out exactly how to pick the ideal one for your small company needs. Audit services drop under basic or monetary accounting. General audit refers to regular duties, such as videotaping deals, whereas financial accountancy prepare for future development. You can employ an accountant to go into information and run reports or work with a certified public accountant that gives monetary guidance.

They might also fix up banking declarations and document payments. Prepare and file income tax return, make quarterly tax settlements, file extensions and manage internal revenue service audits. Business Valuation Services. Small company owners additionally evaluate their tax obligation burden and stay abreast of upcoming adjustments to avoid paying even more than essential. Generate financial statements, consisting of the balance sheet, profit and loss (P&L), money circulation, and earnings statements.

Succentrix Business Advisors Can Be Fun For Everyone

Track work hours, compute earnings, withhold tax obligations, issue checks to staff members and guarantee precision. Accounting solutions may additionally include making pay-roll tax settlements. On top of that, you can hire professionals to develop and establish up your accountancy system, provide economic planning suggestions and describe financial declarations. You can outsource chief economic policeman (CFO) solutions, such as sequence planning and oversight of mergings and purchases.

Usually, small company owners outsource tax services first and add payroll assistance as their company grows., 68% of respondents use an outside tax obligation professional or accounting professional to prepare their firm's tax obligations.

Create a list of processes and obligations, and highlight those that you're willing to contract out. Next, it's time to find the right bookkeeping provider (Accounting Franchise). Now that you have an idea of what sort of audit services you need, the concern browse this site is, that should you work with to give them? For instance, while a bookkeeper deals with data access, a CPA can speak on your behalf to the internal revenue service and give financial guidance.

Get This Report on Succentrix Business Advisors

Before making a decision, think about these concerns: Do you want a regional accountancy expert, or are you comfortable working virtually? Should your outsourced solutions incorporate with existing accountancy tools? Do you need a mobile app or on-line site to supervise your accountancy services?

Given you by Let's Make Tea Breaks Happen! Make an application for a Pure Leaf Tea Break Give The Pure Fallen Leave Tea Break Grants Program for small companies and 501( c)( 3) nonprofits is now open! Look for a possibility to fund concepts that cultivate much healthier workplace society and norms! Ideas can be brand-new or already underway, can come from HR, C-level, or the frontline- as long as they enhance employee health with culture modification.

Something failed. Wait a moment and try once again Try once more.

Advisors give valuable understandings into tax obligation strategies, making sure services lessen tax liabilities while abiding by complex tax guidelines. Tax planning includes aggressive steps to enhance a company's tax placement, such as deductions, debts, and rewards. Staying on par with ever-evolving bookkeeping criteria and governing requirements is vital for services. Accounting Advisory experts aid in economic reporting, ensuring precise and certified economic declarations.

Examine This Report on Succentrix Business Advisors

Right here's an in-depth consider these necessary abilities: Analytical skills is a crucial ability of Accountancy Advisory Solutions. You ought to be competent in gathering and assessing monetary data, drawing purposeful understandings, and making data-driven referrals. These abilities will allow you to assess economic efficiency, determine trends, and deal notified assistance to your customers.

Interacting properly to clients is a crucial skill every accountant need to have. You must have the ability to convey complicated economic information and understandings to customers and stakeholders in a clear, reasonable fashion. This includes the capability to convert financial jargon right into plain language, produce thorough reports, and provide impactful discussions.

The Succentrix Business Advisors Ideas

Audit Advisory companies use modeling methods to replicate numerous economic scenarios, evaluate potential results, and assistance decision-making. Proficiency in economic modeling is essential for accurate forecasting and calculated planning. As an accountancy advising company you should be skilled in economic policies, accountancy requirements, and tax laws pertinent to your customers' markets.

Report this page